The Malaysian government recently released the 2023 budget, which includes adjustments to personal income tax rates that have caught the attention of society. Paying taxes is a responsibility for everyone, and this announcement has wide-ranging implications. During an economic downturn, it’s important to save as much money as possible. By paying less unnecessary taxes, you can keep more money in your wallet or account. Here are some personal tax benefits to look out for.

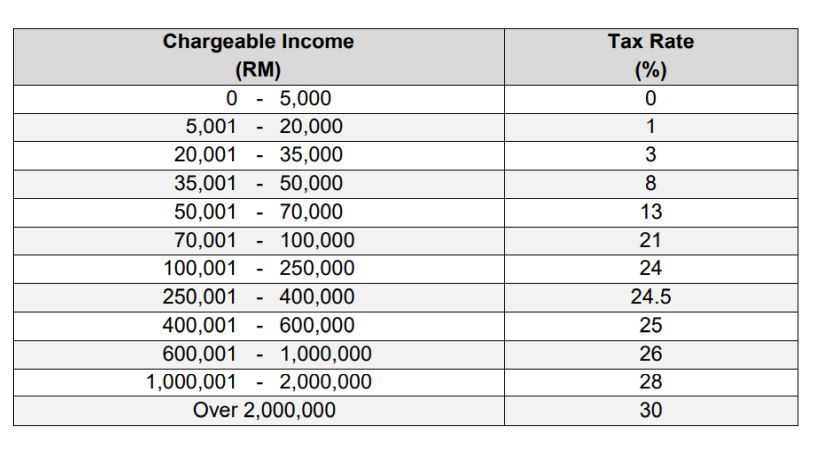

Let’s consider an analogy: Mr. A earns RM5,000 per month, which adds up to an annual income of RM60,000. Without any tax deduction, he would have had to pay personal income tax of RM3,100 in 2022 (RM1,800 for the first RM50,000, and RM1,300 for the remaining RM10,000 at 13%). After the tax rate was lowered in 2023, he will only have to pay RM2,600 (RM1,500 for the first RM50,000, and RM1,100 for the remaining RM10,000 at 11%). This translates to savings of RM500 in taxes.

As the saying goes, with greater ability comes greater responsibility. On the other hand, people with taxable income above RM100,000 will have to pay more tax this year. Low- and middle-income taxpayers are pleased with the increase in income tax deductions and the reduction in tax rates. However, some people may still need to pay more due to the rising cost of living, which may not be fully offset by the deductions. Therefore, this adjustment can bring joy to some families and sorrow to others.

Luxury tax The government’s proposed luxury tax has caused a stir. The exact details of this new tax are not yet clear, so it is difficult to judge the scope and level of its impact on us. However, once this tax law is implemented, purchasing luxury goods in Malaysia will become more expensive than in neighboring countries. Experts warn that this could affect our country’s tourism industry, as tourists who want to buy luxury goods may choose to spend their money in other countries.

Personal income tax relief There are some adjustments to the 2023 tax relief compared to the existing tax relief:

(1) Child care fees for registered nursery schools or kindergartens The maximum deduction remains at RM3,000. Its validity is extended by one more year to the taxable year 2024.

(2) Medical expenses for individuals, spouses, or children suffering from serious diseases The amount of relief available has been increased from RM8,000 to RM10,000, and this tax relief has also been extended to rehabilitation expenses for neurodevelopmental disabilities such as autism, Down syndrome, and specific learning disabilities, up to a maximum of RM4,000. This relief is effective from the 2023 tax year.

In addition to these adjustments to existing deductions, the government has also announced that donations to the following organizations are tax deductible:

(1) Non-profit organizations with sports development programs (2) Charitable hospitals operated by private limited companies (limited to 10% of gross income) (3) The Film Community Fund (Tabung Komuniti Filem) and the National Film Development Fund (Pembangunan Filem Kenegaraan) under the Malaysian National Film Board (Finas)

Various stamp duty exemptions Stamp Duty Exemption for Transfers of Immovable Property Between Family Members The 2023 Budget has made a compassionate adjustment to the transfer of real estate between family members. Prior to this, transfers between parents and children have only been exempted at 50%, while grandparents are required to pay stamp duty at the valorem rate if they transfer immovable property to their grandchildren.

Discussion about this post